Much is made of the concept of ‘edge passing’ in MTTs, with little in the way of conclusive research being done. Over the course of two previous articles, entitled ‘Profitability Thresholds I: Why ICM Isn’t Just For Final Tables‘, and ‘Profitability Thresholds II: Quantifying Edges And Building A New Model‘, I’ve endeavoured to elucidate some of the ideas that might help us to reach some useful conclusions.

Now, several months on from Part II, I believe I’ve successfully drawn up a framework that will allow us to analyse edge-passing decisions in the same way we analyse ICM decisions. I submit this model, which I’ve named the Variable Edge Model or VEM for short, for your approval – I’m fully aware there might be some flaws in it that I haven’t yet identified, so I welcome any feedback that might help us to improve its accuracy and utility.

The only caveat before we begin is that this model is designed as a tool for retrospective hand analysis – much like ICM, it’s very difficult to make specific calculations using the model in-game, but when looking at a decision we’ve made and trying to analyse its efficiency, the model can be extremely useful. Let’s start with the basics of how I arrived at the VEM itself.

Using ICM as a starting point

ICM is the foundation of the concept of edge-passing – it introduces us to the idea that in tournament poker, there are things more important than immediate chip EV (cEV). One of those is, of course, actual dollar EV ($EV), and another is the future cEV we may be able to gain by passing up a particular edge – in other words, by deliberately turning down an opportunity to make a potentially +cEV play.

When making ICM calculations, we accept that passing up a significant cEV edge can be a good idea if the play is not profitable in $EV terms, and we must apply a similar principle to VEM calculations. For the purposes of such calculations, we will refer to a new term – ‘edge EV’, or ‘eEV’.

When making ICM calculations, we accept that passing up a significant cEV edge can be a good idea if the play is not profitable in $EV terms, and we must apply a similar principle to VEM calculations. For the purposes of such calculations, we will refer to a new term – ‘edge EV’, or ‘eEV’.

ICM works by assigning a dollar value to each player’s stack size, and placing greater emphasis on the potential change in that dollar value than on the amount of chips to be gained or lost with a decision. We can transfer this logic over to the VEM very simply – instead of assigning each player’s stack a dollar value and prioritising $EV over cEV, we simply assign them a certain ‘edge value’ (otherwise known as a winrate) instead.

Until we reach the final table or the later stages of a tournament and begin making calculations in terms of $EV, we can use eEV as a fairly accurate judgment of which edges constitute an acceptable risk for us to take. The question now becomes, “how do we measure eEV?”

EVbb/100 winrates – the foundation of eEV

In order to calculate acceptable risks, we have to know what we’re risking on both sides of the equation – what we gain by taking the risk, and what we gain in future by turning it down. We can very easily calculate what we stand to gain on the cEV side of a decision – it’s not difficult to use a program like HoldemResources Calculator or CardRunnersEV to calculate the exact cEV of a specific play, based on either Nash equilibrium ranges or whatever exploitative adjustments we might choose to make.

The problem comes when we try to calculate the other side of the equation. Unlike $EV and ICM (which are absolute, since a dollar is a dollar no matter who you are), the potential gain from passing up a cEV spot varies from player to player, depending on how good the player is at picking up future edges once they pass one up. In short, the higher your winrate, the more edges you can turn down.

If you’re a Holdem Manager 2 or PokerTracker 4 user (which you really should be) then you’ll know that figuring out your own winrate is not a difficult process. All you have to do is look at your EVbb/100 number (Adj BB/100 on PT4) – this will tell you how much you make per 100 hands, and therefore how much you make per hand (this will be important later).

Filtering by different stack sizes will give you a more specific idea of how you play at certain stack depths. In order to simplify the example calculations I’m going to provide, I’m going to draw up a template of what a solid winning low/mid-stakes MTT regular’s approximate stats might look like at each stack size, based on evidence I’ve drawn from my coaching experience.

150bb+: 20bb/100, 0.2bb/hand

100-150bb: 15bb/100, 0.15bb/hand

80-100bb: 12bb/100, 0.12bb/hand

60-80bb: 10bb/100, 0.1bb/hand

40-60bb: 8bb/100, 0.08bb/hand

25-40bb: 7bb/100, 0.07bb/hand

15-25bb: 6bb/100, 0.06bb/hand

10-15bb: 5bb/100, 0.05bb/hand

0-10bb: 8bb/100, 0.08bb/hand*

*winrates at 0-10bb are often inflated since they include all the times where a player is all-in for 3bb or less and risking very little for a chance to win the blinds and antes

We’re going to use this fictional player – let’s call them Player X – and their winrates to look at some examples of the VEM in action. Just as we might look at certain +cEV spots at final tables and recontextualise them in the light of ICM and $EV, we’re going to look at these early-game and mid-game spots according to the VEM and eEV.

I’ve noted the winrates on a per hand basis since passing up an edge only guarantees us one more hand in the tournament to actualise our winrate – we could bust on the next hand, after all. The final thing to note before we start is that these calculations are to be done after we determine that a spot is +cEV – if a spot is not +cEV, there is no reason to ever take it, unless in certain rare instances where the only alternative to one -cEV spot is an even more -cEV spot very soon after.

Adapting for changing circumstances

The main advantage that the VEM gives us, in comparison to simply looking at a cEV value and deciding if we think it’s enough to justify a play, is that it allows us to cater for the fact that our edge changes as our stack changes. I’ve heard many people justify turning down a profitable 10bb preflop shove because they “have a huge edge on the field”, or avoid reshoving for 15bb because they “can find a better spot”. This is almost always just another way of saying “I’m afraid of busting this tournament”, but it’s also a drastic overstatement of how easy it is to actually make a profit when you have a 10bb stack. How much do you really think you’re going to crush the table over the next few hands once you fold?

With that in mind, let’s take a look at an example. Let’s imagine Player X is analysing a hand where they were in the early stages of a tournament, and faced with a river decision in a big pot. Their opponent, Player Y, bet 30bb into a pot of 30bb, creating a pot of 60bb. Player X had 50bb behind and Player Y had them covered. If Player X called and won, their stack would jump up to 110bb. If they called and lost, it would drop to 20bb. If they folded, it would stay at 50bb. Player X needed 33% equity in order to make the call +cEV, and they estimated they had 40%, so they called.

In this circumstance, the call was +cEV to the tune of 6bb(or 6bb/hand). This number was achieved using Will Tipton’s stack-based EV measurement, one I find very useful – 40% of the time when X calls they end up with 110bb, and 60% of the time they end up with 20bb, so we simply calculate (0.4 x 110) + (0.6 x 20) = 56bb, which is 6bb greater than the 50bb they started with. But was the call +eEV? Was that 6bb gain enough to justify the risk to Player X’s stack? Let’s substitute the stack sizes for winrates and see what we get.

At 50bb, X’s edge is currently around 0.08bb/hand. If they call, then 40% of the time their edge is going to go up to around 0.15bb/hand, and 60% of the time it’s going to go down to around 0.06bb/hand. A quick bit of math gives us (0.4 x 0.15) + (0.6 x 0.06) = 0.096bb/hand. Thus, the play is +eEV by 0.016bb/hand, which justifies the call.

However, if the spot were a little thinner while still being a call, such as if Player X had only 34% equity instead of 40%, things might change. The math then becomes (0.34 x 0.15) + (0.66 x 0.06) = 0.051 + 0.0396 = 0.0906bb/hand, making it a little closer, but still +EV. If we play around with Player X’s winrates, we can dig a little deeper.

Let’s imagine that instead of Player X, we’re dealing with Player A, a fairly competent recreational player, who doesn’t have much experience playing deep-stacked poker and mostly focuses on turbo SNGs. A player like that might have a winrate somewhere in the region of 0.03bb/hand at 20bb stacks, 0.05bb/hand at 50bb, and 0.08bb/hand at 110bb.

If we adapt the math from the 34% equity example to suit those numbers, we get (0.34 x 0.08) + (0.66 x 0.03) = 0.0272 + 0.0198 = 0.047bb/hand. This is less than the 0.05bb/hand Player A would be making by folding, and therefore the call may be +cEV, but it is -eEV. These thin spots are the spots where the VEM is the most useful, and you can imagine how big some of the eEV gaps would be in situations where the player in question had big leaks in their game affecting their winrates at specific stack sizes.

Applications in short-stacked play

As mentioned above, many of the instances where players choose to “wait for a better spot” are in short-stacked situations. They vastly over-estimate their own edge at short stacks, and underestimate how much they gain by folding. Let’s look at an example of the VEM applied to a short-stacked situation.

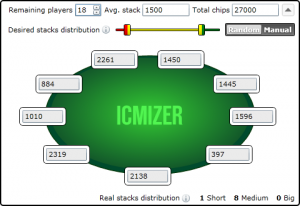

The advantage we have in these situations is that we don’t have to figure out the EV of a play (expressed in bb/hand) ourselves – we can use a program to do it for us. HoldemResources Calculator and ICMIZER will both give accurate readouts of the exact profitability of a preflop shove, whether we’re choosing to play according to Nash equilibrium ranges or exploitatively.

It’s a lot harder to estimate exactly how often we get called when there are multiple players left to act behind, and variations in stack sizes will mean that sometimes we’re not risking all of what we have left if not everyone covers us, but for simplicity’s sake, let’s assume we’re blind vs blind in a 9-handed game against a player who covers us. Player X is analysing a hand where they made a preflop shove with K2o for their last 12bb and generated 0.1bb of profit in cEV terms at the Nash equilibrium.

It’s +cEV, so hypothetically it’s justified, but was this a +eEV play? Well, Player X has a winrate of 0.05bb/hand at a 12bb stack size, so it’s tempting to suggest that since 0.1bb > 0.05bb, the shove was good. However, we need to consider the changes in winrate just like we would in any other spot.

When X is the one making the shove instead of the call, the math gets a little more complex. We have to factor in how often X is getting called (46.6% of the time at the Nash equilibrium), the equity X has when called by that calling range (39.7%) and the changes in X’s winrate. The breakdown is as follows:

X gets a fold 53.4% of the time and their stack goes up to just over 14bb.

X gets called 46.6% of the time.

When X gets called, they win 39.7% of the time and their stack goes up to just over 24bb.

When X gets called, they lose 60.3% of the time and their stack goes down to zero, busting them from the tournament.

Now let’s do the same again and replace the stack sizes with winrates:

53.4% of the time their edge stays at roughly 0.05bb/hand = 0.0267

18.5% of the time (39.7% of the 46.6% they get called) their edge goes up to around 0.06bb/hand = 0.0111

28.1% of the time (the remaining 60.3% of the 46.6%) their edge goes down to 0bb/hand = 0

X also has the option to fold and stay at 0.05bb/hand by going down to 11.5bb.

0.0267 + 0.0111 + 0 = 0.0378bb/hand, which seems to indicate that in this particular instance, folding would be slightly more +eEV than shoving. It’s worth noting a few things, however – this is a Nash equilibrium calculation, and many players will in reality be calling much tighter than 46.6% of the time; the winrate categories I outlined didn’t account for differences between 12bb and 14bb, or between 12bb and 11.5bb; and most importantly, that since we’re dealing with extremely small numbers here, we need to have a very solid idea of our winrates in order to justify not taking spots like these.

A more illuminating version of this spot comes when we look at a situation that comes along frequently with low-stakes players – the math says you should shove, but you just don’t feel comfortable. Let’s say that we’re now dealing with Player B, a recreational player who mostly plays cash games and has very little experience in short-stacked tournaments. Player B has a winrate of 0.02bb/hand at 15-25bb and is slightly below breakeven at -0.01bb/hand at 10-15bb. This is fairly generous – I’ve coached players with significant negative winrates at these stacks, so being roughly breakeven isn’t awful.

Now let’s say that Player B is in the same spot with K2o, but doesn’t know about Nash equilibrium ranges, and thinks that the big blind would be calling the shove with around 20% of hands. Let’s look at the math breakdown once again:

80% of the time B gets a fold, and their edge stays at -0.01bb/hand = -0.008

20% of the time B gets called.

6.1% of the time (30.7% equity x 20%) B gets called and wins, and their edge rises to 0.02bb/hand = 0.00122

13.9% of the time (69.3% x 20%) B gets called and loses, and their edge reverts to 0bb/hand = 0

B also has the option to fold and remain at -0.01bb/hand.

This gives us -0.008 + 0.00122 + 0 = -0.00678bb/hand, a slightly slower rate of losing than Player B would achieve by folding. Ergo, this is a +eEV spot that Player B, as someone who doesn’t play well at short stacks, absolutely has to take. The more of these spots B takes, the bigger their edge will get at this stack size, and the greater the possibility that they will find some +cEV spots in future that will actually turn out to be -eEV for them, giving them room to fold.

A final thought

The VEM is far from perfect – I’m still running into complications trying to denominate the difference between a 0bb/hand edge (i.e. breakeven play) and having zero chips in your stack, and developing a smoother way to integrate the VEM with ICM – but I believe it provides a solid analytical framework that applies to a variety of situations. In general, the principles upholding it are fairly straightforward – since maximum achievable edges get bigger the deeper stacks get, it’s usually the case that there will be strong correlation between +cEV plays and +eEV ones.

However, since we’re dealing with actual player winrates and not simply maximum achievable winrates, it was necessary to construct a framework that allows us to cater for the fact that most players’ winrates don’t just get steadily higher as stacks get deeper. People have different skill sets, and many players are better at short stacks than deep stacks, or better at middle stacks than at either short or deep stacks. The VEM provides insight for each of us into how our own overall poker skill level can, and indeed should, impact the decisions we make at the table. Self-awareness is crucial in all aspects of life, and that’s especially true of poker.

If you have any questions or comments about the VEM or advice as to how I could improve it, I’d love to hear your feedback. Please drop me a comment below, PM me on TPE, or tweet me @theginger45 and we can discuss it.

aaaaaaaaa

cool article!. I haven’t read an entire poker article in years but this 1 kept me captivated. Well done.

theginger45

Wow, high praise indeed! Thank you. Glad you enjoyed it!

greave doggy

Nice, I came looking for the other two articles after looking at a couple of deep stacked spots in my hand histories and was stoked to find this update waiting to be read 🙂 Awesome read.

greave doggy

Gave my own comment a 5 star rating while trying to rate the article, haha well done greave doggy

Dustitute

Brilliant article! I know I am late to the party but I love this 🙂